Following the 2008 financial crisis, the performance of RMBS and related financial derivatives declined as housing prices dropped. A decade later, the COVID-driven economic shutdowns may trigger litigation arising from declines in the performance of CMBS against financial services firms. This is especially true in those sectors most vulnerable to ongoing COVID-related impacts and restrictions, such as retail, hospitality, travel, and student housing.

CMBS are backed by loans on income-producing properties, such as multifamily properties, office buildings, industrial properties, retail centers, hotels, and health care facilities, among others. The economic shutdowns have greatly impacted commercial real estate and the CMBS they collateralize. CMBS delinquencies have been exacerbated by the federal government’s decision to generally exclude the commercial mortgage markets from COVID-related stimulus and relief packages. The hospitality and retail industries have been the most impacted.

CMBS certificates generate income from interest and principal payments of the underlying loans, which is collected by servicers and provided to the trustee who directs the payments to investors via the waterfall distribution. CMBS loans can default in two ways: when a borrower is unable to pay interest during the loan term, and when the borrower is unable to make their principal balloon payment. When defaults occur, servicing responsibilities are transferred to a special servicer. The special servicer is typically appointed (and can be replaced) by a junior certificateholder, known as the controlling class representative.

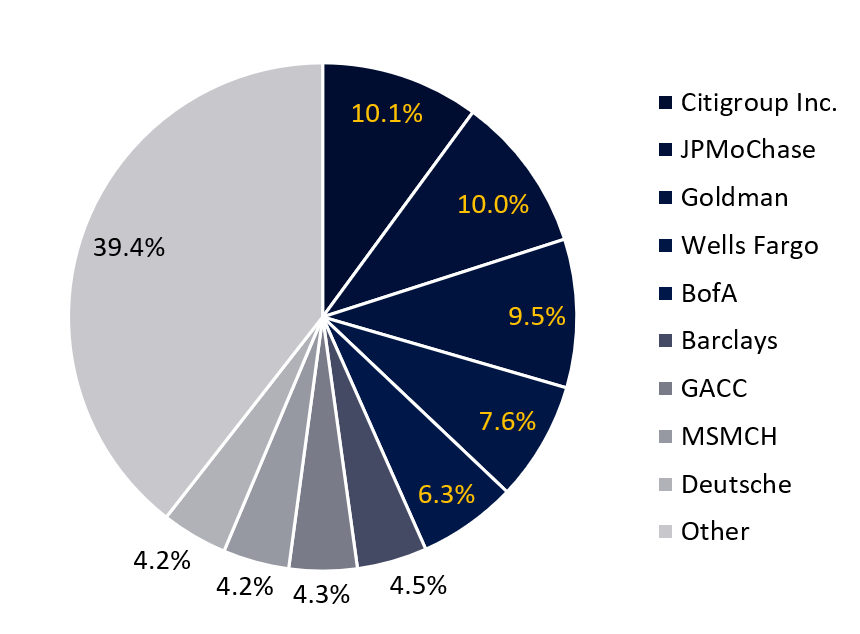

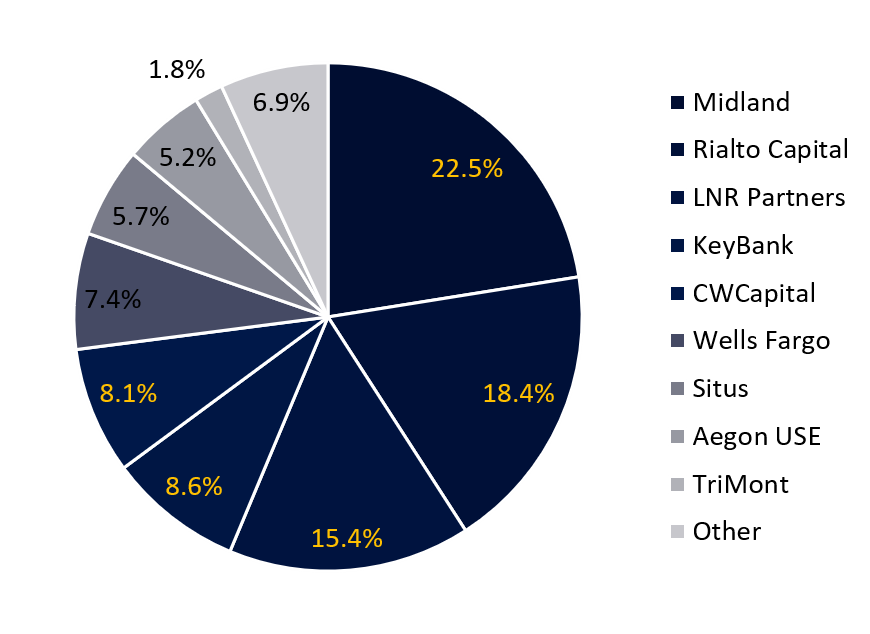

Key Players: U.S. Non-Agency CMBS

Top Loan Originators |

Top Loan Servicers |

|

|

|

Three Master Servicers account for over 98% of the market: Wells Fargo (54.1%), Midland (27.7%) and KeyBank (16.5%).

Key Trends in CMBS

CMBS & RMBS Outstanding

Of all nonagency MBS outstanding, the share represented by CMBS has nearly doubled since 2007 as the share of non-agency RMBS has rapidly declined.

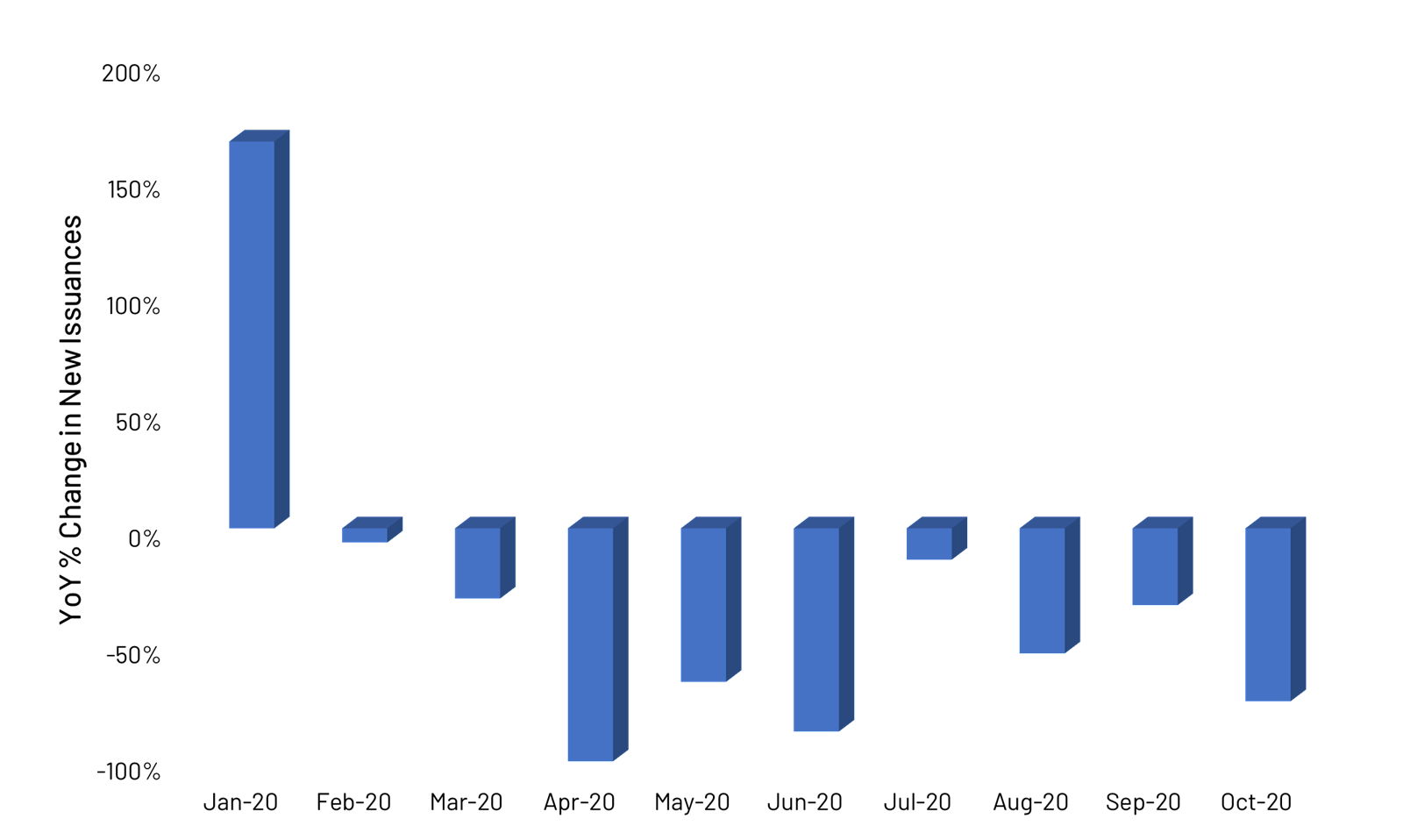

New Issuances in 2020

According to an S&P report, 2019 was the “strongest year for U.S. CMBS issuance since the last financial crisis” and they originally expected the growth to carry to 2020. However, in light of the COVID-19 pandemic, non-agency CMBS issuance declined significantly.

Trend to SASB Transactions

Within the non-agency CMBS market there has been a trend away from conduit transactions and towards Single Asset/Single Borrower (SASB) transactions. SASB transactions are generally backed by one large loan or by a portfolio owned by one borrower, and therefore are less diversified than conduit transactions, which are collateralized by multiple properties spanning a range of industry types.

Commercial Loan Delinquencies

After a period of relative stability, commercial loan delinquencies increased in 2020 as business operations froze due to virus concerns. Lodging and retail properties had the greatest delinquency rates, hovering at 19.66% and 14.21%, respectively, as of November 2020.

CMBS Ratings

Multiple CMBS have already been downgraded or placed on watch lists, and others are likely to follow. According to a FitchRatings article from September 2020, CMBS has the largest share of downgrades as a percent of bonds in the sector. Hotel and retail CMBS compose the largest number of defaults and both the US and EMEA recently published reports that provide an update on CMBS credit trends.

|

|

Loan Workout Requests

Following the closure of all non-essential businesses, some commercial tenants began asking for relief in the form of rent abatements, lease amendments, and others (such as The Gap, Inc.) temporarily reduced or halted rental payments. If the pandemic continues to affect tenant businesses, borrower requests will shift from forbearances to modifications involving term extensions, interest-rate reductions, and principal forgiveness.

Potential Claims

COVID-driven economic shutdowns may trigger litigation arising from declines in the performance of CMBS. In this section, we present our predictions about claims may arise related to CMBS as the pandemic unfolds.

Fraud & Misrepresentation Claims

- As defaults on CMBS loans continues to rise, we may see an increase in claims that CMBS offering materials misrepresented borrower data. CMBS offering documents provide loan characteristics that may form the basis of securities-related claims such as debt service coverage ratios (“DSCR”). Like DTI in the RMBS context, DSCR indicate the borrower’s ability to service their debt.

- Public companies’ disclosure regarding their CMBS portfolios may be at issue. For example, if the disclosed risks associated with CMBS portfolios on their balance sheets was insufficient or misrepresented and the stock prices dropped once the “actual risk” was revealed, investors are likely to bring securities fraud suits against the public companies.

Breach of Contract Repurchase Claims

Repurchase Claims: As defaults on CMBS loans continue to rise during the pandemic, we may see an increase in repurchase requests and R&W breach litigation. Likewise, if parties see an opportunity to recover some of what they've lost through repurchase requests, there could be a spike in disputes. Given the size of the CMBS loans, and depending on the originator, repurchase claims may be pushed into bankruptcy court. CMBS have a small number of loans which may allow plaintiffs to focus their analysis on a limited number of large mortgages rather than on thousands or tens of thousands of mortgages like as in the RMBS repurchase cases. Accordingly, put back claim can be economical on a single defaulted loan.

Companion Loans: In a loan combination, a “co-lender agreement” designates a “controlling note holder” that may direct servicing decisions for the loans. Thus, a loan may be subject to servicing decisions by parties to another trust, creating potential conflicts of interest. In the example below, both loans are serviced according to the CMBS 1 PSA and serviced by its servicer. The controlling class rep. (Class B) is responsible for certain servicing decisions.

Debt Held Pari Passu: In commercial real estate the pari passu is often used as part of a waterfall structure and the cash is distributed to all the pari passu investors or partners at the same time. Like in the previous example, the loan will be serviced according to the CMBS 1 PSA and serviced by its servicer. The controlling class rep. (Class B) is responsible for certain servicing decisions.

Repurchase Agreements (REITs): CMBS are likely to be at issue in disputes involving REITs and the repurchase repo agreements that grant the lending banks the right to make margin calls.

- Lenders, concerned about the effects of the coronavirus on values of financial assets, may prompt them to issue margin calls (require the REITs to post additional collateral if the secured collateral declines in value).

- REITs may challenge these margin calls based on an erroneous valuation of the CMBS portfolio. They will claim that it was undervalued by determining market value based on a temporarily depressed market during the pandemic.

These cases will raise issues regarding how CMBS should be valued in current market conditions, and the rights and duties of the parties to the repo agreements.

Disputes Regarding CMBS Appraisals

Modifications are likely to accelerate due to the disruption caused by COVID-19 and may trigger appraisal reductions for the loans collateralizing the CMBS. Unlike in RMBS where the servicer may advance principal and interest until the payments are deemed unrecoverable, servicer advances in CMBS can be limited by appraisal reductions. Following an appraisal reduction event as defined in the PSA (such as a modification that reduces a periodic payment), the servicer can conduct an internal valuation of the property or use an outside appraiser. The appraisal reduction amount (“ARA”) is the excess of the loan balance over 90% of the new appraised value.

- Disputes regarding servicers advances affected by the appraisal reduction amount.

- Disputes may surface regarding the valuations of the properties collateralizing CMBS that are difficult to value due to lack of comparables and/or volatile cashflows due to macroeconomic business cycles.

Disputes Regarding CMBS Valuation

In M&A transactions, if one or both companies have CMBS in their portfolios, the valuations of their CMBS investments can become a center of potential disputes.

Servicer Disputes

The loss of revenue associated with closing a business during the pandemic has put a strain on commercial tenants’ ability to meet their obligations under commercial leases and tenants will look for ways to manage lease obligations. Many commercial leases include a “force majeure” clause that operates to either temporarily delay, or excuse, certain landlord and tenant obligations while the business is closed. However, many of these clauses temporarily delay or excuse performance of obligations except for the tenant's obligation to continue to make its lease payments.

Disputes may arise in the CMBS context regarding the servicers ability to enforce lease payments and the interpretation of these provisions.

If the embedded PDF is unavailable, refresh the page or download to view the presentation.